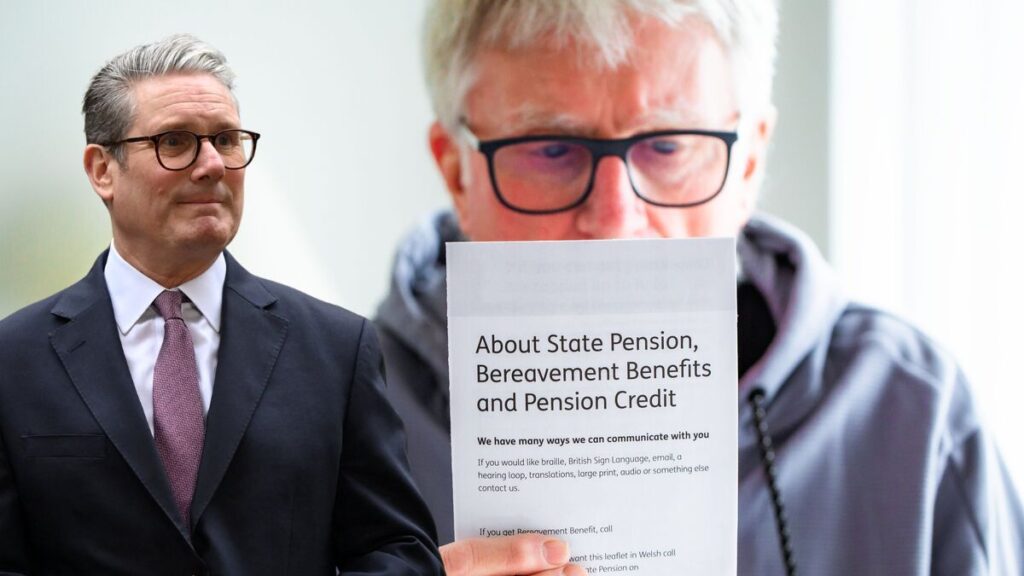

The Department for Work and Pensions (DWP) has confirmed updated guidance on how property is assessed for Pension Credit, Housing Benefit and other means-tested support.

The changes do not mean pensioners will lose their homes. However, they clarify how second properties, rental income and asset transfers are treated when calculating benefit entitlement.

For most pensioners who live in their own home and own no additional property, the main residence remains protected and is not counted as capital.

What the DWP Means by “Property Rules”

When DWP refers to property rules, it means how the value of property is treated in means-tested benefit assessments.

This includes:

- Whether a property counts as capital

- Whether its value is ignored

- Whether rental income affects entitlement

- Whether transferred assets are still assessed

These rules apply primarily to Pension Credit, Housing Benefit and other income-related support.

They do not apply to the basic State Pension, which is not means-tested.

What Has Not Changed – Your Main Home Is Still Disregarded

The most important point for homeowners is this:

If you live in your property as your main residence, its value is ignored when assessing eligibility for means-tested benefits.

This applies regardless of:

- Market value

- Property type (house, flat, bungalow)

- Increases in house prices

For the majority of pensioners who own only the home they live in, there is no immediate change.

What Has Changed – Additional Properties Under Closer Scrutiny

The updated guidance focuses on second or additional properties.

The following are normally counted as capital:

- Second homes

- Buy-to-let properties

- Holiday homes

- Land not attached to your main residence

If you own a second property, its net value (after deducting any outstanding mortgage) may be included in capital calculations.

Capital limits for Pension Credit and other means-tested benefits still apply.

Rental Income and Pension Credit

If you rent out:

- A room in your home, or

- A separate property

The rental income may be treated as income for benefit purposes.

However:

- Certain allowable expenses may be deducted

- Not all gross rental income is automatically counted

Failure to declare rental income could lead to overpayments or repayment demands.

Capital Thresholds and Benefit Impact

Means-tested benefits apply capital rules.

For Pension Credit:

- Lower levels of savings may affect entitlement gradually

- Higher capital levels may remove entitlement entirely

If a second property pushes total capital above the relevant threshold, support may reduce or stop.

Each case is assessed individually.

Deprivation of Assets – Transfers to Family Members

The DWP has strengthened its position on deliberate deprivation of assets.

If a pensioner:

- Transfers property to relatives

- Sells property below market value

- Gifts ownership shortly before claiming benefits

The DWP can assess entitlement as if the asset is still owned.

Officials consider:

- Timing of the transfer

- Intention

- Financial circumstances at the time

If deprivation is established, benefits may be refused or reduced.

Temporary Absence and Care Situations

There are important exceptions.

A property may be temporarily disregarded if:

- The pensioner moves into residential care but intends to return

- The home is empty due to illness

- A spouse or qualifying relative continues living there

However, once no qualifying person occupies the home, its value may be considered in care cost assessments by local authorities.

This is separate from DWP benefits but often causes confusion.

Impact on Care Costs

While DWP handles benefits, local councils assess assets for social care funding.

If a spouse or certain relatives still live in the property, it is usually disregarded.

If the property becomes unoccupied, councils may include it in care fee calculations.

Independent advice is strongly recommended before making property decisions related to care.

Who Is Most Affected?

The confirmed guidance primarily affects:

- Pensioners with second properties

- Landlords receiving rental income

- Those considering transferring property

- Households with complex ownership structures

Those who own only their main home are unlikely to see a direct impact.

What Pensioners Should Do Now

If you own additional property, you should:

- Review your total capital position

- Declare all property and rental income accurately

- Avoid transferring property without seeking advice

- Check entitlement rules on GOV.UK

Those unsure about their situation should seek guidance from:

- Citizens Advice

- Age UK

- A qualified financial adviser

Taking action before applying for benefits can prevent disputes later.

Why the Government Updated the Guidance

The DWP says the changes are intended to:

- Improve fairness

- Prevent misuse of asset transfers

- Ensure support reaches those in genuine need

- Align enforcement with existing law

The update is described as clarification and tightening of rules, rather than a new policy removing property protection.

FAQs

Is the government taking pensioners’ homes?

No. Your main home remains disregarded for means-tested benefits if you live in it.

Does a second home affect Pension Credit?

Yes. A second property is usually counted as capital and may reduce entitlement.

Does rental income count?

Yes. Rental income must be declared and may affect benefit calculations.

What is deprivation of assets?

It is when assets are deliberately given away to qualify for benefits. DWP can still assess you as owning them.

Will this affect my State Pension?

No. The State Pension is not means-tested.

Should I transfer my home to my children?

Seek independent financial advice before making any transfer. It could affect benefits and care assessments.